The truth comes crashing down – 40,000 Malaysians lost their jobs in 2016, 18,000 in six months 2017

The truth comes crashing down – 40,000 Malaysians lost their jobs in 2016, 18,000 in six months 2017

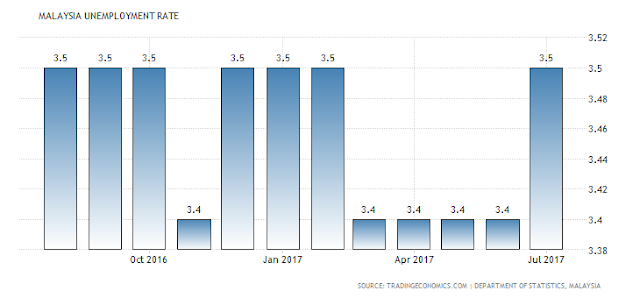

The Singapore-based ANN news network reported that 40,000 Malaysians lost their jobs last year with another 18,000 in the first half of 2017.

Yes. Malaysians are looking in the mirror and are asking themselves: Is there light at the end of the tunnel for the economy to improve and more job creations?

“No matter what analysts and politicians may say or spin news to serve their masters or agenda, the truth can never be hidden forever,” Gerakan Deputy Speaker Syed Abdul Razak Alsagoff said.

He said no matter how one tried to paint a positive picture of a country’s economy, “it is only a matter of time reality hits the rakyat (people) hard”.

“And, losing jobs are as hard as it can get,” he added.

Syed Razak said under such trying and challenging domestic and global economic sluggishness and downturn, “there is nothing much for individuals to do but to look harder for jobs and petty business opportunities to rough out the difficult times”.

“Innovative petty business can grow immensely, if one strives hard to succeed. The key words are to work doubly hard or don’t be lazy,” he added.

Syed Razak, who is Gerakan's nominee to contest N.37 Bukit Lanjan in the coming 14th General Election (GE14), said the ANN report was not the only damning news for Malaysians.

These two news headlines should also be worrying:

Ø Business confidence among Malaysian firms improves for the third consecutive quarter

Ø World economy, markets entering more dangerous time

“If business confidence among Malaysian firms are really improving, why then are thousands of Malaysians losing their jobs since last year?

“Are we, the rakyat and governments, accepting reality and responding positively to prepare for the hard times by taking prudent measures to help ease the socio-economic pressures?

“Or are we just talking to syiok sendiri (self-gratifying)?”he asked.

Here are the three news reports for you to digest:

"SHOCK DATA – NAJIB’S TALK OF A BOOMING ECONOMY A LIE: 40,000 MALAYSIANS RETRENCHED IN 2016, NEARLY 18,000 UP TO JUNE THIS YEAR

Politics | October 10, 2017 by | 0 Comments

These two news headlines should also be worrying:

Ø Business confidence among Malaysian firms improves for the third consecutive quarter

Ø World economy, markets entering more dangerous time

“If business confidence among Malaysian firms are really improving, why then are thousands of Malaysians losing their jobs since last year?

“Are we, the rakyat and governments, accepting reality and responding positively to prepare for the hard times by taking prudent measures to help ease the socio-economic pressures?

“Or are we just talking to syiok sendiri (self-gratifying)?”he asked.

Here are the three news reports for you to digest:

"SHOCK DATA – NAJIB’S TALK OF A BOOMING ECONOMY A LIE: 40,000 MALAYSIANS RETRENCHED IN 2016, NEARLY 18,000 UP TO JUNE THIS YEAR

Politics | October 10, 2017 by | 0 Comments

KUALA LUMPUR – In 2016, almost 40,000 Malaysian employees were retrenched from their jobs, according to data reported to the Labour Department.

As of June this year, 17,798 workers have been retrenched.

These numbers, however, are just the tip of the iceberg.

It is believed that the actual number of Malaysians who lost their jobs during this period is significantly higher, as many small and medium enterprises (SMEs) and micro-enterprises are not aware of the requirement to report lay-offs and retrenchments to the Labour Department.

One of these thousands of affected workers is 50-year-old Goh Chee Seng, who worked at a cable manufacturing factory in Shah Alam before he was retrenched, along with over 100 other workers and lower management staff.

The company had been riddled with issues and its management changed several times during Goh’s 29-year stint there.

It all went downhill after the workers began getting their salaries late from September last year.

“We would receive our salaries about one or two months late, and this went on until February this year.

“We are not well-off and getting our salaries late was already difficult but after February, we did not get our salaries at all for three months,” said Goh, who is the sole breadwinner of his family.

He also takes care of his 86-year-old mother at their home in Kapar.

As of June this year, 17,798 workers have been retrenched.

These numbers, however, are just the tip of the iceberg.

It is believed that the actual number of Malaysians who lost their jobs during this period is significantly higher, as many small and medium enterprises (SMEs) and micro-enterprises are not aware of the requirement to report lay-offs and retrenchments to the Labour Department.

One of these thousands of affected workers is 50-year-old Goh Chee Seng, who worked at a cable manufacturing factory in Shah Alam before he was retrenched, along with over 100 other workers and lower management staff.

The company had been riddled with issues and its management changed several times during Goh’s 29-year stint there.

It all went downhill after the workers began getting their salaries late from September last year.

“We would receive our salaries about one or two months late, and this went on until February this year.

“We are not well-off and getting our salaries late was already difficult but after February, we did not get our salaries at all for three months,” said Goh, who is the sole breadwinner of his family.

He also takes care of his 86-year-old mother at their home in Kapar.

In May, the company informed the staff that they would be retrenched as new management would be taking over.

“They promised us that our three-month salary would be paid to us by November this year. It was very sudden, but there was nothing we could do about it. We signed the letters and left.

“Suddenly, we were jobless. We had no other source of income coming in every month, no money to put food on the table or pay our bills,” Goh said.

He added that he had no one to turn to for help or who would at least extend temporary financial relief and help him find a new job.

Luckily, as Goh is above 50, he was able to withdraw a portion of his Employees Provident Fund savings in order to make ends meet.

While the money is a great help for now, Goh worries about how long his EPF savings will last and knows that he needs to secure a job as soon as possible.

“Whenever I attend interviews or call a company regarding a job opening, one of the first questions they ask me is ‘How old are you?’

“They think twice about hiring a person of my age. Many of the other staff who lost their jobs are in their 50s as well.

“I am still fit, skilled and able to contribute productively,” he lamented.

Most employers, he added, would prefer to hire foreign workers, especially for jobs in factories, as they are perceived to be more affordable and easily available.

“I am very stressed about my future and how I will continue to care for my family.

“My mother is also very worried about me and keeps asking me when I will return to work,” said Goh.

He is also worried that the stress will affect his elderly mother’s health.

Goh, along with his former colleagues, had sought the help of the Electrical Industry Workers Union under the umbrella of the Malaysian Trades Union Congress (MTUC), which facilitated dialogue sessions with the former employers to ensure that their salaries and compensation would be paid as promised.

But in terms of immediate financial assistance, there is not much help that Goh can get. He also worries that his former employer may not pay his outstanding wages as promised.

There are many others out there like Goh, who are stuck in similar or worse situations after being retrenched from their jobs.

While many companies that retrench their workers do pay out compensations, it often takes months or even years for the funds to be disbursed.

Employment insurance schemes vary from country to country, but many have a system in place that provides temporary financial relief to those who have been retrenched (see graphic).

“They promised us that our three-month salary would be paid to us by November this year. It was very sudden, but there was nothing we could do about it. We signed the letters and left.

“Suddenly, we were jobless. We had no other source of income coming in every month, no money to put food on the table or pay our bills,” Goh said.

He added that he had no one to turn to for help or who would at least extend temporary financial relief and help him find a new job.

Luckily, as Goh is above 50, he was able to withdraw a portion of his Employees Provident Fund savings in order to make ends meet.

While the money is a great help for now, Goh worries about how long his EPF savings will last and knows that he needs to secure a job as soon as possible.

“Whenever I attend interviews or call a company regarding a job opening, one of the first questions they ask me is ‘How old are you?’

“They think twice about hiring a person of my age. Many of the other staff who lost their jobs are in their 50s as well.

“I am still fit, skilled and able to contribute productively,” he lamented.

Most employers, he added, would prefer to hire foreign workers, especially for jobs in factories, as they are perceived to be more affordable and easily available.

“I am very stressed about my future and how I will continue to care for my family.

“My mother is also very worried about me and keeps asking me when I will return to work,” said Goh.

He is also worried that the stress will affect his elderly mother’s health.

Goh, along with his former colleagues, had sought the help of the Electrical Industry Workers Union under the umbrella of the Malaysian Trades Union Congress (MTUC), which facilitated dialogue sessions with the former employers to ensure that their salaries and compensation would be paid as promised.

But in terms of immediate financial assistance, there is not much help that Goh can get. He also worries that his former employer may not pay his outstanding wages as promised.

There are many others out there like Goh, who are stuck in similar or worse situations after being retrenched from their jobs.

While many companies that retrench their workers do pay out compensations, it often takes months or even years for the funds to be disbursed.

Employment insurance schemes vary from country to country, but many have a system in place that provides temporary financial relief to those who have been retrenched (see graphic).

Business confidence among Malaysian firms improves for the third consecutive quarter

ECONOMY

Tuesday, 10 Oct 2017

11:52 AM MYT

by daljit dhesi

KUALA LUMPUR: Business sentiment among Malaysian companies improved further for the third consecutive quarter in the fourth quarter (Q4 17), reaching its new peak in six consecutive quarters.

According to Dun & Bradstreet (D&B) Malaysia’s Business Optimism Index (BOI) study, overall BOI climbed from +3.40 percentage points in Q3 17 to +5.52 percentage points in Q4 17. On a year-on-year (y-o-y) basis, BOI rose from +3.83 percentage points in Q4 16 to +5.52 percentage points in Q4 2017.

Dun & Bradstreet Malaysia CEO Audrey Chia said it expect the outlook for Malaysian businesses to end off on a relatively good note for 2017.

This is largely attributed to positive growth within the construction sector as well as an increase in electronics, food and beverage manufacturing activities over the recent months, she added.

“On the domestic front, the government has a development plan in place which focuses on boosting the country’s labour productivity, skills upgrading of employees and infrastructure, which bodes well for businesses here and making Malaysia competitive in high value-added sectors.

“As an open economy, however, Malaysia is highly vulnerable to any increase in protectionism, which is a non-negligible possibility in the current anti-globalisation environment.

“With the acceleration in inflation rates, a slowdown in consumer spending and dampening of household sentiments will also be expected. Hence, we remain cautiously optimistic in our outlook for the rest of the year,“ Chia said.

Dun & Bradstreet is one of the world leading business information providers and this is the 19th D&B BOI study being released in Malaysia.

The six business indicators under the quarterly BOI study include volume of sales, net profits, selling price, inventory level, employees and new orders.

Five of six indicators have climbed upwards on a quarter-on-quarter (q-o-q) basis. Volume of sales rose from +3.88 percentage points in Q3 17 to +5.03 percentage points in Q4 17.

Net profits rebounded from the contractionary zone, from -3.88 percentage points in Q3 17 to +5.53 percentage points in Q4 17. Selling price climbed from +2.91 percentage points in Q3 17 to +4.52 percentage points in Q4 17.

New orders eased from +8.74 percentage points in Q3 17 to +7.54 percentage points in Q4 17. Inventory levels jumped from +4.85 percentage points in Q3 17 to +6.53 percentage points in Q4 2017.

Employment levels inched upwards from +3.88 percentage points in Q3 17 to +4.0 percentage points in Q4 2017. On a year-on-year (y-o-y) basis, four of six business indicators have improved for Q4 2017.

Both volume of sales and net profits have moderated downwards from +7.0 percentage points in Q4 16 to +5.03 percentage points in Q4 17 and from +7.0 percentage points in Q4 16 to +5.33 percentage points in Q4 17.

Selling price increased moderately from +0.5 percentage points in Q3 16 to +2.91 percentage points in Q3 17. New orders jumped from +5.50 percentage points in Q4 16 to +7.54 percentage points in Q4 17.

Inventory levels climbed visibly from +0.50 percentage points in Q4 16 to +6.53 percentage points in Q4 2017. Employment levels rose from +2.50 percentage points in Q4 16 to +4.0 percentage points in Q4 17.

Three sectors have emerged as the most optimistic with all six indicators each in positive territory. According to D&B Malaysia, the construction, manufacturing and services sectors were most upbeat for Q4 17.

Construction

Following a pessimistic third quarter, the construction sector has emerged as one of the most optimistic sectors with six indicators in expansionary zone for Q4 17.

Volume of sales has risen from +11.11 percentage points in Q3 17 to +28.57 percentage points in Q4 17. Both net profits and selling price climbed from 0 percentage point in Q3 17 to 14.29 percentage points in Q4 17.

Both new orders and inventory have also jumped visibly from 0 percentage point in Q3 17 to +28.57 percentage points in Q4 17; and from 0 percentage point in +42.86 percentage points in Q4 17. Employment levels rebounded from -11.11 percentage points in Q3 17 to +14.29 percentage points

in Q4 17.

Manufacturing

The outlook for the manufacturing sector has also displayed improvements with all six indicators in positive territory, as compared to three of six indicators in Q3 17.

Volume of sales, net profits and selling price rebounded from the contractionary zone from -7.69 percentage points in Q3 2017 to +7.27 percentage points in Q4 17; from -19.23 percentage points in Q3 17 to +3.64 percentage points in Q4 17; and from -3.85 percentage points in Q3 17 to +5.45

percentage points in Q4 17.

New orders eased from +7.69 percentage points in Q3 17 to +5.45 percentage points in Q4 17 while inventory levels moderated from +5.77 percentage points in Q3 17 to +1.82 percentage points in Q4 17.

Employment levels have also dropped from +7.69 percentage points in Q3 17 to +1.82 percentage points in Q4 17.

Services

Following a moderation in outlook, the services sector is expected to be relatively more upbeat compared to the previous quarter with 6 indicators in expansionary zone.

Net profits rebounded from negative territory from -1.28 percentage points in Q3 17 to +2.30 percentage points in Q4 17. Employment levels climbed from +5.13 percentage points in Q3 17 to +6.82 percentage points in Q4 17.

Selling price increased from +1.28 percentage points in Q3 17 to +2.30 percentage points in Q4 17. Both inventory levels and new orders have eased from +3.85 percentage points in Q3 17 to +1.15 percentage points in Q4 17; and from +7.69 percentage points in Q3 17 to +2.30 percentage points in Q4 17.

Volume of sales has also moderated downwards from +5.13 percentage points in Q3 17 to +1.13 percentage points in Q4 17. – The Star Online

World economy, markets entering more dangerous time

BANKING

Monday, 9 Oct 2017

4:43 PM MYT

|

| The Federal Reserve -- which has been raising interest rates since 2015 -- takes the next step toward normalizing monetary policy this month. |

The Federal Reserve -- which has been raising interest rates since 2015 -- takes the next step toward normalizing monetary policy this month when it starts to reduce its $4.5 trillion balance sheet.

The European Central Bank is expected to soon lay out its own plans for cutting asset purchases, possibly followed by a rate increase by the Bank of England in November.

The Bank of Canada has already raised borrowing costs.

The trick for policy makers gathering this week in Washington for the semi-annual meeting of the International Monetary Fund is to scale back their support without hurting the global economy by upsetting financial markets that have been juiced by monetary largesse for years.

It’s “the end of an era,” Ray Dalio, who leads the world’s largest hedge fund at Bridgewater Associates, said in a Sept. 21 report for clients. The world economy and the markets are “entering a more dangerous time,” he co-wrote in the report, according to a money manager who’s seen it.

Compounding the difficulty: uncertainty over who’ll lead the world’s most powerful central bank, with Vice Chairman Stanley Fischer about to step down and Chair Janet Yellen’s term expiring in February.

“There is at least a risk that we see some unraveling in the markets” as central banks exit from quantitative easing, said Joachim Fels, a global economic adviser of Pacific Investment Management Co.

For now at least, all looks well on the economic front. The global expansion is coming off its best quarter since 2010 and the underlying momentum looks strong, Bruce Kasman and his fellow economists at JPMorgan Chase & Co. said in a Sept. 29 report.

“It feels like the global economy is in something close to a synchronous upturn” for the first time in years, said David Stockton, a former Fed official who is now a senior fellow at the Peterson Institute for International Economics in Washington.

Central bankers are moving to take advantage -- even with inflation below their targets. Bloomberg Intelligence Chief Economist Michael McDonough sees net asset purchases by the central banks falling to a monthly $33 billion at the end of 2018, from $131 billion in September.

Interest rates also are going up in some countries. Both the Fed and the Bank of Canada have boosted rates twice in 2017 and U.S. policy makers have penciled in one more increase before year-end.

No Tightening

Not every central bank is turning to tightening, of course.

The People’s Bank of China, whose benchmark interest rate remains at a record low, is balancing a push to slow overall credit growth without hurting the economy. Japan is nowhere close to curbing its monetary support and Australian and South Korean rates also remain at lows.

“We don’t have to raise interest rates just because they’re going up elsewhere overseas,” Bank of Japan Governor Haruhiko Kuroda told reporters last month.

Those policy makers who are moving are doing so gingerly. The Fed’s plan to pare its balance sheet has been months in the making and starts off with asset reductions of just $10 billion per month. ECB President Mario Draghi has stressed that any change in policy will be gradual and ensure significant monetary support remains.

The Fed’s “well-advertised, well-anticipated, very gradual wind down in the balance sheet isn’t going to have much effect,” said former Fed Vice Chairman Donald Kohn, now a senior fellow at the Brookings Institution in Washington.

What’s more, no matter how much they cut back on stimulus, central banks are unlikely to return to the pre-crisis economic environment any time soon, if ever. The Fed, for example, ran a balance sheet of less than $1 trillion prior to 2008 and its benchmark rate was as high as 5.5 percent in 2006, compared with its current 1 percent to 1.25 percent target range.

So far, the measures haven’t fazed frothy financial markets. Global stock markets are trading at or near record highs while corporate bond spreads are around post-financial crisis lows. The fallout in currency markets also has been limited by the fact that a number of central banks are moving in tandem.

Joint Action

But joint action carries risks as well, potentially amplifying the impact of individual central bank moves.

“One wouldn’t want to be too assured that once everybody is kind of moving in the same direction, that there may be some discontinuities in markets,” former Fed Governor Daniel Tarullo said. After all, “we’ve never done this before,” he added, referring to the rollback in quantitative easing.

Ebrahim Rahbari and his fellow Citigroup economists see a “material risk” that the tapering of bond purchases by central banks could puncture asset prices and drag down global economic growth.

In some ways, policy makers have no one to blame but themselves for the delicate situation they now find themselves in. The danger is they’ve let the party go on too long, and it’s already too late.

“Asset prices of all sorts have gotten way out of line with historic experience,” Harvard University professor Martin Feldstein said in an Oct. 6 interview with Bloomberg Television.

“The real danger is that, as that unwinds, it could bring down consumer spending, it could bring down economic activity.” – Bloomberg/The Star Online"

|

N.37 LET BUKIT LANJAN SOAR WITH SYED ABDUL RAZAK ALSAGOFF

|

Comments

Post a Comment